Prelude

The proliferation of stablecoins has been massive and with haste. In 2024 alone, the average supply of fiat-backed stablecoins grew by 53% to reach an all-time high of $200B. Moreover, stablecoins have handled more than 4.7B total transactions and have settled $5.8T in total transaction volume this past year. To put this into perspective, Visa settled $15.7T of volume in 2024. The stablecoins USDC and USDT now account for more than a third of Visa’s transaction volume. This does not account for decentralized versions such as Ethena’s USDe and Maker’s DAI, which represent $5.7B and $4.7B in circulating supply, respectively.

Stablecoins are now ubiquitous and long term product market fit and adoption. To this point, however, their application has been overly simplistic and that’s okay, it’s part of their beauty. Users deposit $1 of fiat and receive $1 worth of a given stablecoin onchain, pegged 1:1, redeemable at any time. USDT and USDC have largely controlled the market, but this is beginning to shift. Traditional payments giants like Stripe, PayPal, and Revolut have taken heed and are rapidly entering the space. In October 2024, for instance, Stripe acquired the stablecoin payments platform Bridge for $1.1B along with the web3 wallet infrastructure provider Triangle. Payments giants are not just operating as the middleware, they are becoming the very gateway into the space.

Yet the new frontier of digital money is not simply a store of value, it is programmatic. It has form and function beyond that of traditional fiat. It performs specific tasks for the end user. It is never idle. It is always at work. In a word, the digital dollar is beginning to take agency.

Circle’s acquisition of Hashnote, the largest tokenized money market fund with over $1.5B in deposits, highlights this. Hashnote’s infrastructure functions as a building block between Circle’s USDC and onchain, yield-bearing collateral. Users can now seamlessly move between simply holding a vanilla fiat-backed stablecoin (USDC) to earning yield through tokenized short-term T-bills (USYC) and vice versa, accessible 24/7. Fundamentally, it is moving between cash and yield.

Franklin Templeton’s tokenized money market fund and its BENJI token, which functions like a stablecoin in many ways, further signal the way forward, particularly with the recent deployment to Solana. Pairing this product with Solana Pay, for instance, enables users to hold a money market fund as a default instead of a vanilla stablecoin, earn passive yield on idle capital, and then make purchases directly with their assets whenever they choose. So digital money can move between cash and yield, but with the additional core utility of instant payments.

These are just a few of the many steps towards the new frontier. The design space is wide open, and many different new classes are beginning to take shape, integrating yield and agency in novel ways. Towards the bleeding edge of this are stablecoins that generate yield through arbitrage and MEV, stablecoins that generate yield through aggregation, and the holy grail of contemporary DeFi, stablecoins backed natively by Bitcoin. CAP, Perena, and Yala have emerged to build these applications from the ground up, creating a host of new use cases.[1]

Moreover, blockchains themselves are moving directly down this path. At the heart of digital money are the smart contracts that power them. Every digital dollar onchain is governed by a set of rules that run independently of any human interaction. This is what begins to give them agency. At its very core, it enables developers to embed highly customizable features and functions directly into digital money.

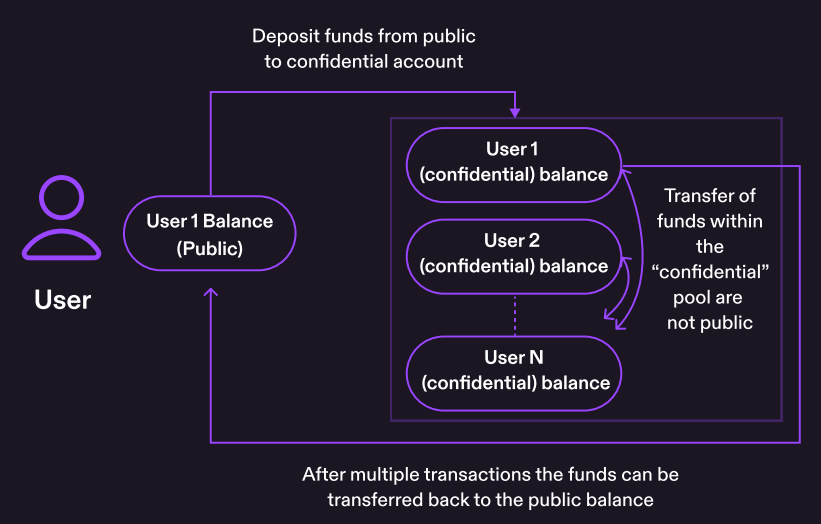

Token extensions on the Solana Program Library are at the forefront of this and allow developers to add advanced functionality directly into their tokens. This includes a variety of powerful features, such as privacy preserving transfers, regulatory and compliance frameworks, and intricate payment logic that runs before settlement. Businesses, for instance, can now pay their employees in USDC or stream payments to third parties without ever revealing transfer amounts. These payments inherently live onchain while remaining entirely private.

The implications are vast and extend well beyond payments in the traditional sense. Any asset, from RWAs and tokenized money market accounts to private OTC deals, can be freely and securely transferred between parties through a confidential transfer extension without ever revealing the transfer amounts. This is all achieved directly within the token, out-of-the-box, and previously was not possible on public blockchains.

Meanwhile, applications can use token extensions to embed program-defined logic to run before transfer settlement. This could mean something as straightforward as automatically collecting platform fees, distributing revenue to token holders, and enforcing royalties each time a token is transferred without any complicated proxy layer required. Or it could mean something far more complex, like taking a specific action if tokens are being sent to a party that is not on a given compliance-related list.

Ultimately, the next evolution is to use these different protocols as primitives for programmatic money that lives onchain in a fully non-custodial manner. Onboarding retail and providing seamless transactions is just the start. Real, sustainable yield is next. Experiments that fundamentally shift the way we think of money from simply a medium of exchange or unit of account are what follows.

Digital Dollars and Real-World Revenue

Stablecoin issuers have become some of the most profitable companies in the world, not just in crypto. In the last 6 months alone, Tether has dominated the entire web3 market with over $2.45B in revenue, while Circle had the 3rd most ($825M). And this just includes the revenue generated from the yield earned on reserve assets like U.S. Treasuries. By comparison, Visa had $35.9B in net revenue in 2024.

This underscores the meteoric rise of stablecoins as a vertical, which has emerged as one of the fastest growing sectors not just in web3, but in all of fintech and beyond. In January 2017, nearly two years after Ethereum mainnet went live and 8 years since the launch of the Bitcoin network, there were less than $10M in total stablecoins in circulation. This number is now close to $205B, representing an increase of 2,039,900%.

The formula is simple: users deposit fiat, the protocol issues a corresponding stablecoin coin, and then holds this fiat collateral in a variety of assets such as U.S. Treasury bills, money market funds, bonds, gold, and even Bitcoin. The more collateral held, the greater the revenue earned. Overall, Tether’s profits for 2024 surpassed $13B, of which an estimated $7B was directly from the yield earned on stablecoin collateral.

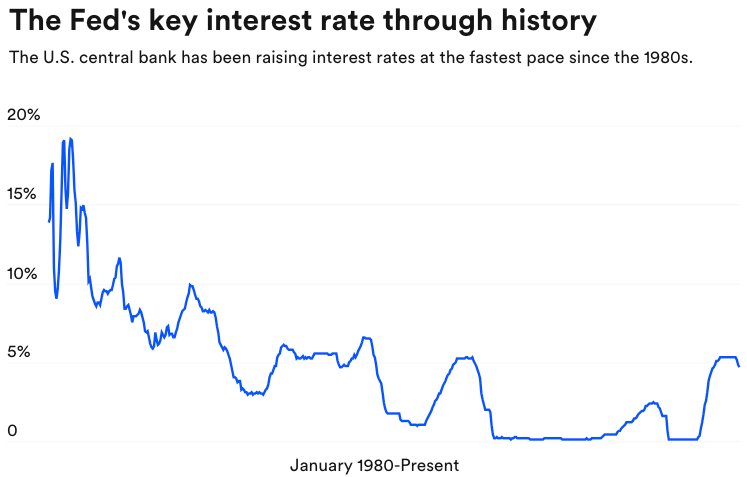

Yet all of this yield flows back to the protocol. The end user does not stand to benefit at all. In a sense, the end user is actually paying an opportunity cost of using the service (i.e. the stablecoin) by forgoing this rate premium. The success of this was largely a product of the higher interest rates, particularly in the United States. As rates compress, this model becomes less profitable.

For issuers that do not control $50B-$140B in deposits like Circle and Tether, it makes market penetration even more challenging, especially for new entrants who no longer have the luxury of simply issuing a generic stablecoin and collecting windfall profits. Even Tether is starting to feel the impact of lower interest rates, as fees have trended downward despite an increase in circulating supply. There has to be more. New competitors sense this, and features such as revenue sharing and permissionless yield-bearing have emerged. The systems that are able to maintain sustainable yield that is not entirely dependent on prevailing interest rates will stand best positioned to challenge the incumbents.

Finally, frontier money is several orders of magnitude more efficient and less human capital-dependent than its legacy counterparts. While Visa was able to manage $13.2T in yearly volume last year, it required more than 31,000 global employees to do so. Tether was able to do roughly a quarter of this volume with less than 200 employees.

Smaller teams that can quickly iterate their products and navigate through an ever-changing landscape, both political and technological, and are not beholden to corporate structures will be best-positioned to succeed. In fact, they may be the only type of team that can emerge from this idea maze.

THE FRONTIER OF PROGRAMMABLE MONEY

Yala

Among the first paths forward is a classic, yet fundamentally challenging one. Building a stablecoin protocol that can access Bitcoin liquidity while creating yield in a sustainable manner. Many have tried, but to date no one has been successful. This remains a core dilemma in decentralized finance since the very beginning: enabling liquidity and capital efficiency through Bitcoin. Part of the challenge is due to Bitcoin’s original architecture, which was designed for simple peer-to-peer transactions rather than complex financial operations. These constraints, especially around block size and frequency limitations, have prevented Bitcoin from fully participating in DeFi.

From a user perspective, Bitcoin holders have historically been reluctant to utilize their Bitcoin for anything other than a store of value. The liquidity gap in the Bitcoin ecosystem is well-documented: $2T of capital is locked within Bitcoin, unable to be used for other opportunities. Users must make a tradeoff between idly holding Bitcoin or reallocating their capital elsewhere. The opportunity cost is real and it is substantial.

Aave lending markets are a good example of this. Utilization rates for wBTC generally sit well below 10%. Currently, over $3.8B Bitcoin has been supplied, but just $312M has been borrowed. Moreover, the expected APY for lending BTC is less than 1%. Part of this stems from the limited opportunities to generate sustainable yield and the general limitations of Bitcoin’s DeFi ecosystem and scaling solutions. Ultimately, it’s expensive to move Bitcoin around and many instances involve wrapping or some other non-native process, adding extra layers of risk that users may not be willing to take.

As Bitcoin surges to new all-time highs, institutional inflows into ETFs surpass $40B, and for the first time there is a crypto-friendly US Administration in office, the demand for Bitcoin utility and liquidity is stronger than ever. Yet the demand for Bitcoin yield is even stronger. Yala has emerged to bridge this gap by issuing a Bitcoin-backed stablecoin that can seamlessly bring liquidity to other networks and generate native yield. The end user experience is straightforward: simply deposit Bitcoin into the protocol to mint a stablecoin (YU), use this stablecoin for other purposes and on other networks, such as Ethereum or Solana, and then withdraw the original BTC principle along with any additional yield earned along the way. There is no wrapping or bridging required.

Much of this is powered by Yala’s novel design, which utilizes a variety of different tooling and infrastructures, enabling YU to be issued directly on the Bitcoin blockchain and mapped to other chains. Overall, the protocol allows users to earn yield on their underlying Bitcoin collateral by participating in DeFi opportunities across different blockchain networks, all while preserving Bitcoin’s native security and decentralization.

The demand for this sort of product has been significant. Over 400,000 in testnet BTC deposits have occurred with $18B of YU minted across 1.5M users. Yet this is just general retail. The unlock for institutions and custodians, and a potential BTC strategic reserve could be even more powerful. New primitives and use cases can be built on top of this protocol to improve capital efficiency, reduce opportunity cost, and shift idle BTC into the broader DeFi space. Yala’s institutional feature enables just that: BTC assets remain within the user’s wallets and are locked using a time lock via P2WSH script. This creates a true DeFi ecosystem for Bitcoin and brings the rest of the broader DeFi throughout Ethereum, Solana, and beyond, directly to the custodian’s wallet, again with no need to bridge and take on additional layers of risk.

CAP

As interest rates compress, so too will the profits of the traditional stablecoin issuers and DeFi participants. Soaring inflation and rising interest rates stemming from 2020 created an environment for issuers like Tether and Circle to generate enormous sums of revenue simply by holding their user collateral in treasury bills and short-term deposits. In other words, these issuers collected the risk-free rate for the users.

As rates trend downward, however, margins will narrow. There are generally two paths forward: increase user deposits to keep pace with declining interest rates or create new revenue-generating mechanisms that are not entirely dependent on the prevailing rate. New entrants will not have the luxury to scale and grow their business simply by sitting on user collateral. Moreover, incumbents like Circle may be more inclined to choose the latter path and find other more profitable opportunities, as highlighted by their acquisition of Hashnote. Nevertheless, this is still largely dependent on the US Federal Reserve.

CAP has introduced a new economic design that largely abstracts away the dependence on prevailing rates. Rather than use collateral to generate yield from treasuries, CAP generates yield through a variety of exogenous sources including arbitrage and MEV. Currently, these sources of yield are largely obfuscated from retail, accessible only to large institutions, market makers, and sophisticated MEV organizations. CAP democratizes all of these avenues to any user in the space.

Users can deposit a variety of different types of collateral, including USD, BTC, and ETH to mint a redeemable stablecoin of a corresponding denomination. This collateral is then loaned to an agent within the CAP ecosystem who then uses this as capital to execute a proprietary strategy, such as CEX-DEX arbitrage. Once the strategy is executed and the duration of the loan expires, the agent returns the borrowed capital back to the user along with a portion of the yield generated. User deposits, therefore, are effectively turned into yield-bearing stablecoins and the end user is free to use these to perform other functions while their underlying capital is put to work.

Two immediately important features of this approach are around yield and scalability. In terms of yield, all stablecoins minted through CAP are resolutely designed to generate competitive yield in any market and are not intrinsically tied to the prevailing interest rate. As agents compete for the same pool of capital, only the most performant strategies will prevail. This creates a market in which strategies will continuously need to optimize to meet changes in the broader market. This is also critical for scalability. Given the competition between agents, there will be a multitude of powerful strategies available, rather than just one static strategy, which would most certainly have inherent scaling limitations. Nevertheless, all of these complex moving parts operate beneath the hood, abstracted away from the end user. All the end user needs to do is choose the type of collateral they wish to deposit.

Part of the power of this approach is that all stablecoins minted through the protocol are not only fully collateralized and fully redeemable for the collateral that backs them, but they are fully insured through shared security delegations like Eigenlayer. Restakers and operators collaborate to underwrite and take on the risks of different yield-bearing strategies being deployed. In the event that a given strategy fails or the loan is not repaid, slashing on the shared security layer occurs, and the end user’s principal is repaid, irrespectively. So the operators become the active yield generating agents and restakers underwrite the risk of the individual agents that they delegate to. This creates an ultra-competitive marketplace in which only the best agent strategies can survive, and thus user collateral is constantly being optimized for maximum yield. Meanwhile the end user simply holds their digital dollars and allows the protocol to do the heavy-lifting for them.

Perena

Every bank, institution, and payments provider will move towards issuing their own native stablecoin or at least attempt to do so wherever advantageous. More variations, often perfunctory, will emerge onchain in both the centralized and decentralized forms. The number of stablecoins in circulation could accelerate rapidly, giving users more options than ever.

Ultimately, however, there will be more redundancy and the optionality will be for the same thing. Fundamentally there is no difference between vanilla fiat-backed stablecoins. But for the user, this can become quite complex. Imagine hundreds of different versions of the US dollar floating around and trying to figure out which one you need to complete a purchase for your shaken espresso at Starbucks.

Moreover, there is a stark difference in terms of integrations. Stripe, for instance, may choose to accept one version (e.g., USDC), but not another, especially one from a competitor (e.g., PYUSD). The scenario is similar to the above: one version of the US dollar being accepted at Starbucks, but not at Target. More new stablecoins emerging will lead to fragmented liquidity, siloed liquidity pools, and perhaps most importantly, an increasingly complicated user experience.

In order for all of this to work and be streamlined, at some point there will be a need to aggregate stablecoins and their underlying liquidity. Traditional retail requires that their money works exactly how they expect it to work; no surprises, no limitations.

Rather than functioning as just another stablecoin issuer, and further compounding these issues, Perena is building a novel infrastructure layer for the entire stablecoin ecosystem. One of the more particularly powerful features is a new automated market maker (AMM) design which aggregates different stablecoins into one concentrated pool of liquidity. For end users, this means seamless composability between an ever-growing set of stablecoin options, but also the ability to earn sustainable yield simply by depositing their stablecoins into the protocol for liquidity provision and earning a portion of swap fees. For stablecoin issuers, particularly some of the newer entrants to the markets, this means a more dense concentrated liquidity with a single pool and abstracts away the high capital requirements and complex liquidity management necessary adoption.

The UX is resolutely simple: deposit any supported stablecoin (e.g. USDT, USDC, PYUSD) into Perena’s AMM, receive Liquidity Pool tokens (USD*) as collateral, and generate yield through liquidity provision and the fees earned on swaps. Users can also utilize this singular pool of liquidity to move between different stablecoins and swap with minimal slippage. Value accrual flows directly back to end users through USD* as the token continuously appreciates in value with swap fees and auto-compounds its yield. For more sophisticated users, Perena’s risk architecture allows customized exposure by choosing which stablecoin pools specifically they want to participate in.

Deploying on Solana allows the system to handle heavy traffic with performant speeds and low costs. It also provides direct access to Solana’s $12B DeFi ecosystem and $11.6B stablecoin liquidity, which have grown by 650% and 540% in the last 12 months, respectively.

Overall, this combines the store of value and medium of exchange functions of digital dollars in a new and optimized way: User stablecoin assets with all of their expected features, while simultaneously generating sustainable yield under the hood, largely irrespective of prevailing interest rates or macroeconomic conditions.

The Next Frontier

The next frontier of digital money will be truly programmatic. It will be permissionless. It will be guided by the immutable laws of smart contracts rather than fragile intermediaries. Along this course, stablecoins will begin to adopt features which push them beyond the simple store and transfer of value, they will become inherently yield-bearing and revenue generating. We’ve seen this with the transformation of idle Bitcoin assets with Yala, the novel strategies through CAP, and the digital money infrastructure layer in Perena. While all of these are quite different in terms of their design, the goal is shared: adding a layer of agency to money that is possible only onchain.

Bringing programmable money onchain also means more payments, more applications built for those payments, and the derivatives of those payments. It also means that the core of what money is will be required to change in a very fundamental way. Machine economies with millions of agents constantly talking amongst each other will need native currency to perform high-frequency, low-value transfer. All of this will require highly customizable frameworks that expand the objective function and core utility of digital dollars in circulation.

Ultimately, the next frontier of money will be one in which assets are constantly at work for the end user, abstracting away layers of complexities and the tedium of routine financial tasks. They will earn yield, stream payments, distribute revenue, automatically collect royalties, privately transfer payments, communicate with each other, and much more in the new worlds being created.

[1]: Anagram Ltd. and its affiliates may consult, invest, build, or otherwise have financial interest in companies or projects that are written about in this space. This content is for educational purposes only and does not constitute advice, marketing or solicitation for funding. Certain information contained herein, including in charts and graphics, has been obtained from third parties. While such sources are believed to be reliable, Anagram does not assume any responsibility for the accuracy or completeness of such information. Please see the disclaimer below for more information.

LEGAL DISCLAIMER

The information in this article has been prepared by Anagram Ltd. (“Anagram”) for educational and informational purposes only. Under no circumstances should this, or any post on this website, be construed as solicitation for investment in Anagram, its affiliates, any projects named herein or otherwise. The contents herein, and content available on any associated distribution platforms, including Anagram online social media accounts, should not be construed as or relied upon as investment, legal, tax, or other advice.

Certain information contained herein, including in charts and graphics, has been obtained from third parties. While such sources are believed to be reliable, Anagram does not assume any responsibility for the accuracy or completeness of such information. No assurance is made by Anagram regarding the accuracy or completeness of the information or opinions set forth herein, whether or not obtained from third parties, and Anagram shall not be liable therefor. Certain statements herein are based on subjective beliefs, may differ from the views of other market participants and are subject to change. This article and associated content contains “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially and adversely from those reflected or contemplated in the forward-looking statements.