Introduction

New blockchain native financial primitives are pushing the frontier of digital money and decentralized capital coordination.

The emergence of these next-generation protocols signals a deep shift towards composable, programmable, and globally accessible infrastructure for money, for markets, and perhaps most importantly, for identity.

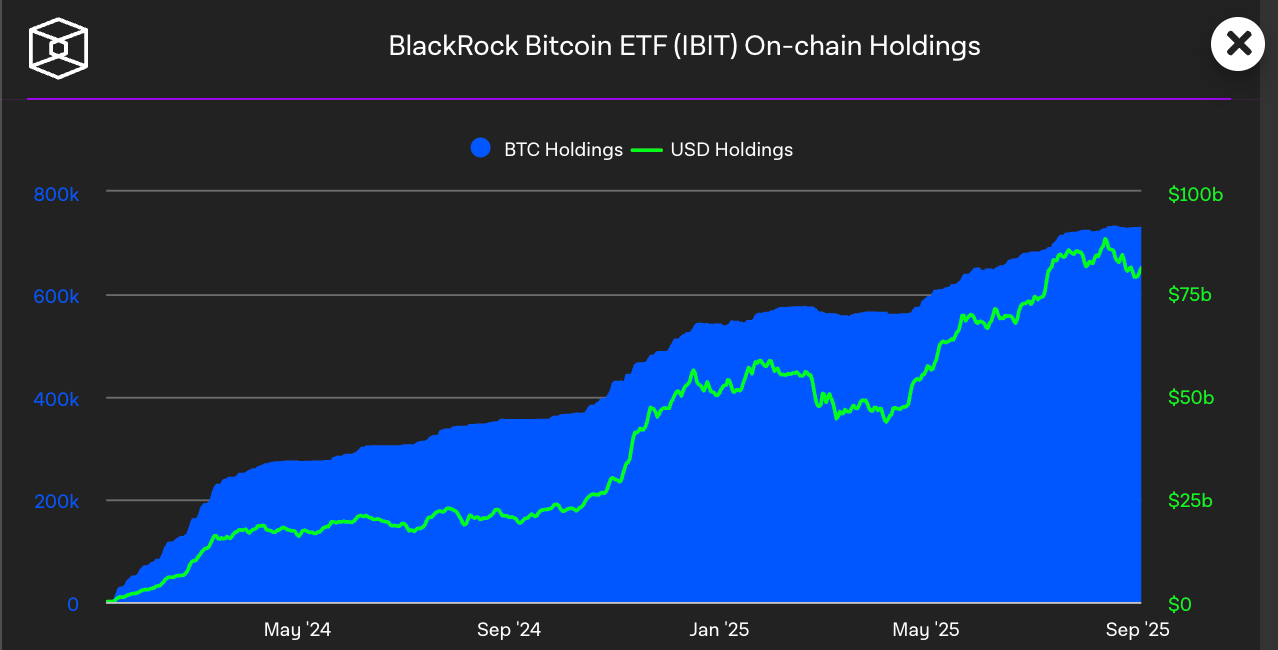

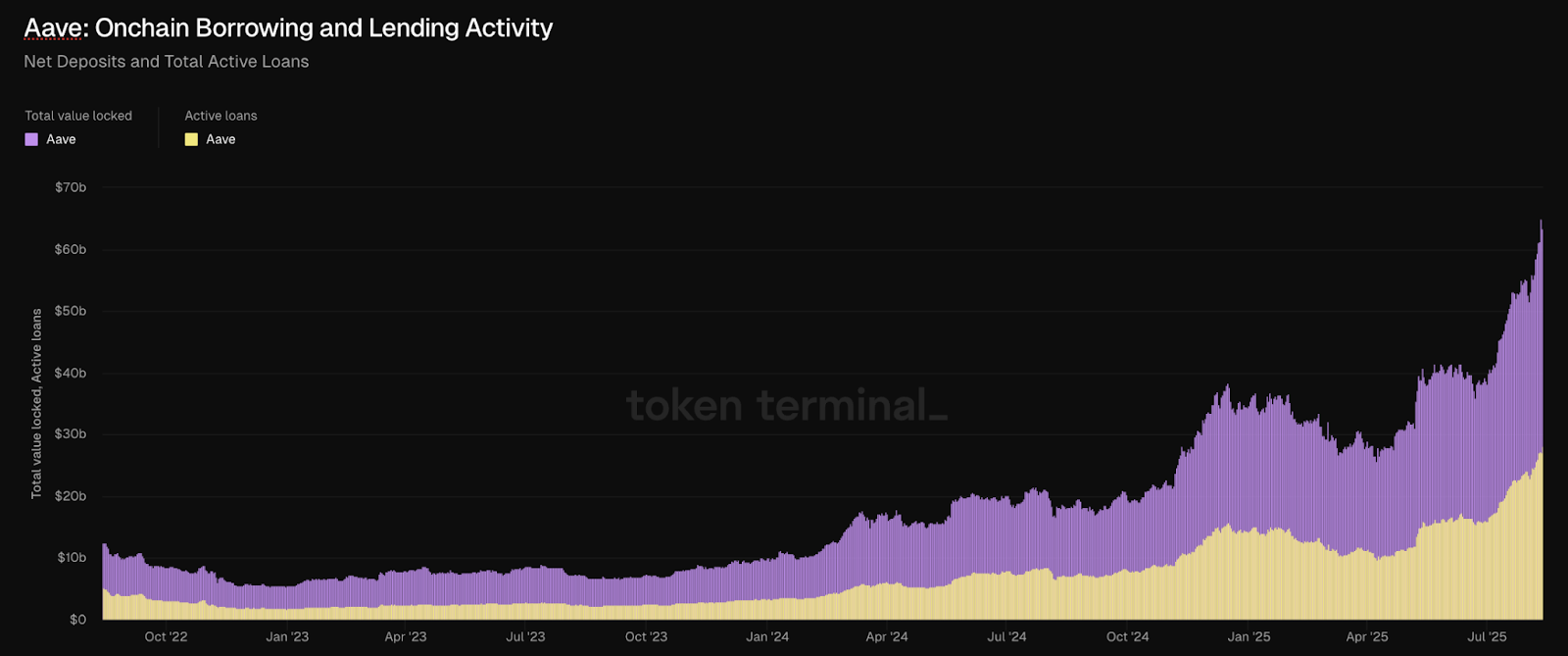

Human and financial capital continue to flow towards digital assets. BlackRock now controls over $80B of spot Bitcoin ETF products, and MicroStrategy now owns more than $75B worth of Bitcoin. Aave has over $66B worth of deposits, which ranks it among the top 40 largest US-chartered commercial banks by consolidated assets, ahead of household names like Barclays ($45B) and Deutsche Bank ($40B). [1]

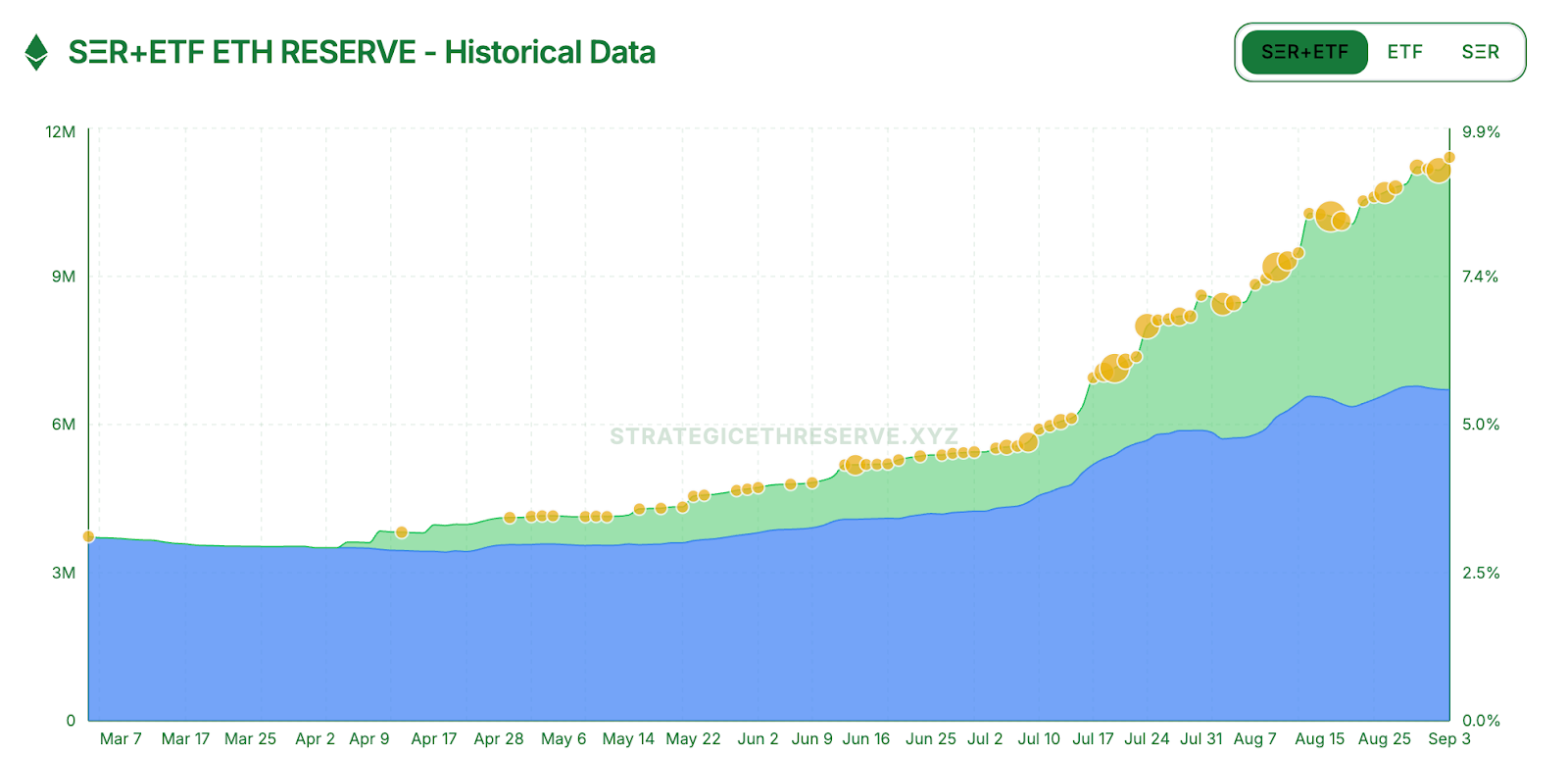

Meanwhile, there has been a frenzy of Digital Asset Treasury (DAT) vehicles emerging[2]. Ethereum treasury strategies like SharpLink Gaming and BitMine now collectively hold over 3,000,000 ETH, accounting for more than 3% of the entire supply. Other publicly traded companies like Sol Strategies, DeFi Development Corporation, and Upexi are amassing treasuries composed of Solana. Hyperliquid Strategies plans to acquire nearly $1B worth of Hyperliquid, and Nano Labs has pledged to acquire 5-10% of the entire supply of BNB.

These inflows are historic. Yet the rails to support everyday usability—things like payments, compliance, and consumer access—remain underdeveloped. As capital surges onchain, user functionality remains confined.

The next wave of protocols is closing this gap. By integrating real-world compliance and usability—in-person payments, sovereign onchain banks, bespoke stablecoins—DeFi is evolving into its next form: programmable finance.

DeFi 1.0: Decentralized, Not Programmable Finance

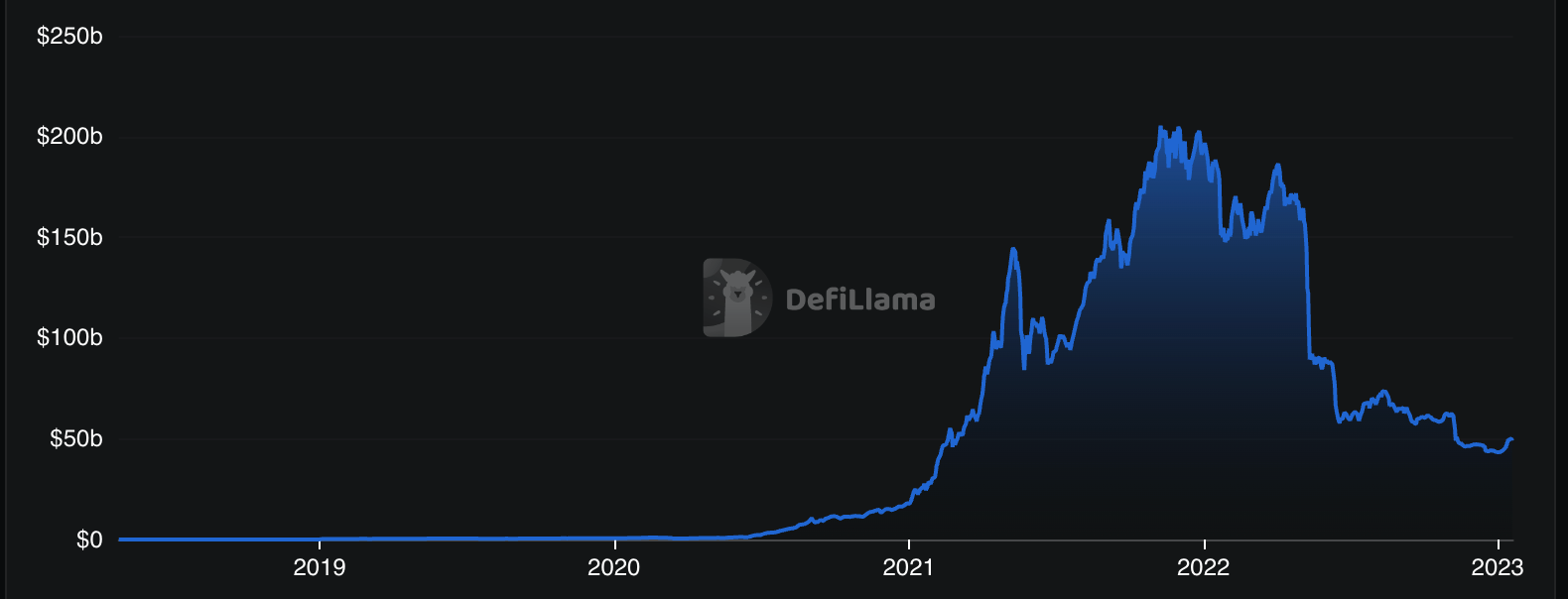

Decentralized finance as we know it began to take shape in the summer of 2020, when the staples of onchain lending and borrowing, trading, liquidity, and stablecoins were born. Protocols like Aave, Uniswap, Maker, and Compound gave users access to programmable money for the first time. Capital poured in and within a few months there was more than $15B sitting in smart contract accounts. The surface area was wide open and builders obliged: from benevolent thought experiments to opportunistic money legos that were not designed to stand. This lasted largely until the collapse of Terra LUNA in May 2022 and then made its final curtain call after FTX collapsed in November 2022.

One particularly important nuance here is that despite the massive design space and open arena for experimentation, virtually all of these early efforts were focused simply and solely on yield generation. All flavors of risk, all sorts of different layering and looping. Little attention was given to real-world integration. Institutional flows were nonexistent, digital asset treasury strategy vehicles hadn’t been born yet, and traditional banking and payments were too boring. In a way, DeFi siloed itself from the rest of the world.

Part of this was by design, part of it was circumstantial. The cryptopunk ethos was to disengage from legacy systems altogether. To rebuild fundamentally broken paradigms from the ground up. Yet even if there was an imperative to build alongside existing infrastructure, and create both compliments and substitutes, the means for doing so were few and far between. Sending digital assets was cost-prohibitive and generally a nonstarter for any routine action. UX was highly fragmented and multi-hop. The shape of onchain banks was beginning to form with billions worth of deposits in decentralized protocol, but there was very little to do with it beyond highly speculative actions.

The next iteration of decentralized finance is equipped with all of the lending, borrowing, trading, and liquidity benefits from the last cycle, but this time it comes with powerful financial rails, settlement layers, and capital formation tools. It brings together powerful privacy primitives and effortless UX. In short, programmable finance bridges existing applications and infrastructure with all of the convenient form and function of traditional banking.

The Onchain Bank

We believe the path forward starts with empowering users with all of the basic features and functions of traditional banking systems, onchain. This allows anyone, at any time, and anywhere, to store their savings onchain, send money, transact, earn yield, and more. All while maintaining ownership. All without risk of seizure, censorship, and without being beholden to an intermediary.

Aave was one of the first to pioneer this and now functions as the cornerstone of decentralized banking: over $63B of liquidity with $28B in active loans, metrics that have seen significant growth and adoption, survived every collapse in the space, and have been nearly immutable to all macro headwinds.

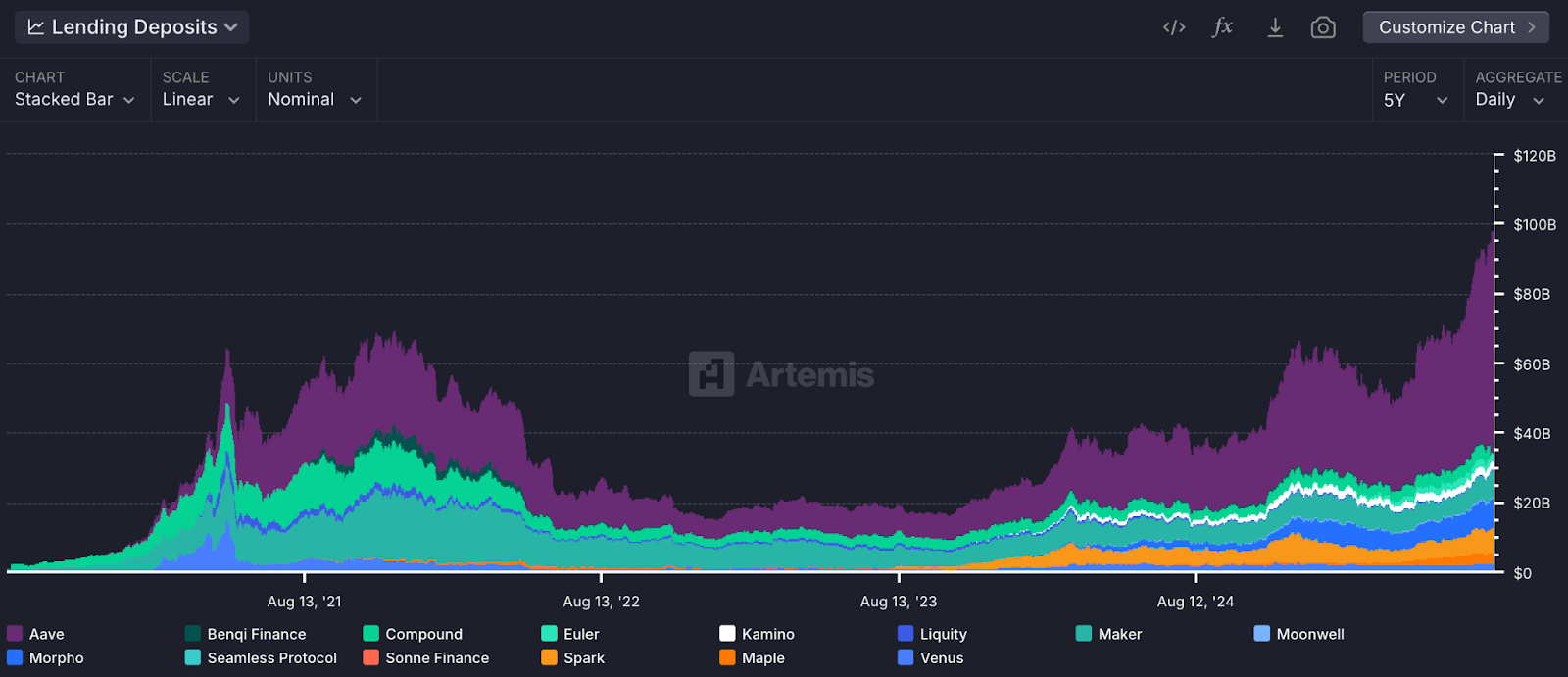

The landscape has since evolved from smart contracts filled with idle capital to a burgeoning ecosystem that is quickly rivaling traditional banking. There is now over $100B in liquidity available along with $42B worth of active loans onchain, and 9 different protocols with at least $2B in total deposits, including Aave ($63B), Morpho ($8B), and Spark ($7.6B). And this has all been achieved with little institutional adoption, and no participation (yet) from DATs and strategic reserves.

The power of the onchain bank, however, extends much further. At its very core, it enables users to lend out virtually any asset, borrow virtually any asset, and allow the open market– not legacy banking systems—to set the rates and conditions. If a borrow falls below a certain threshold, then smart contracts liquidate them automatically. If a user doesn’t have sufficient credit history in the traditional system, they can post collateral and acquire a loan instantly. So automated lending and borrowing opens a world where users can put their assets to work and coordinate capital, all on their own terms.

Moreover, this is a world that is decidedly composable. Unlike traditional banks, where end users can only deposit dollars and borrow dollars, onchain banks facilitate the transformation of fiat into programmable money. For instance, users on Aave can deposit a vanilla stablecoin (e.g. USDC) in exchange for a yield-bearing stablecoin (e.g. aUSDC) and then use that for a variety of other purposes on other onchain banks and DeFi protocols.

Assets beyond cryptocurrency are being tokenized; from money market funds to stocks to mortgages. All of these things will move onchain, and the onchain banking system will function as a clearing house for users to borrow, lend, and trade, all on their own terms and without any intermediaries.

Onchain Banking and Real World Spending

The next step is to bridge onchain banking with real world spending. Assets can live onchain and become programmable, but if they cannot be spent in the real world, their true utility is undermined.

Programmable finance requires that users have the freedom to move on- and off-chain without friction. This means capital coordination onchain and spending digital dollars in the real world making in-person purchases.

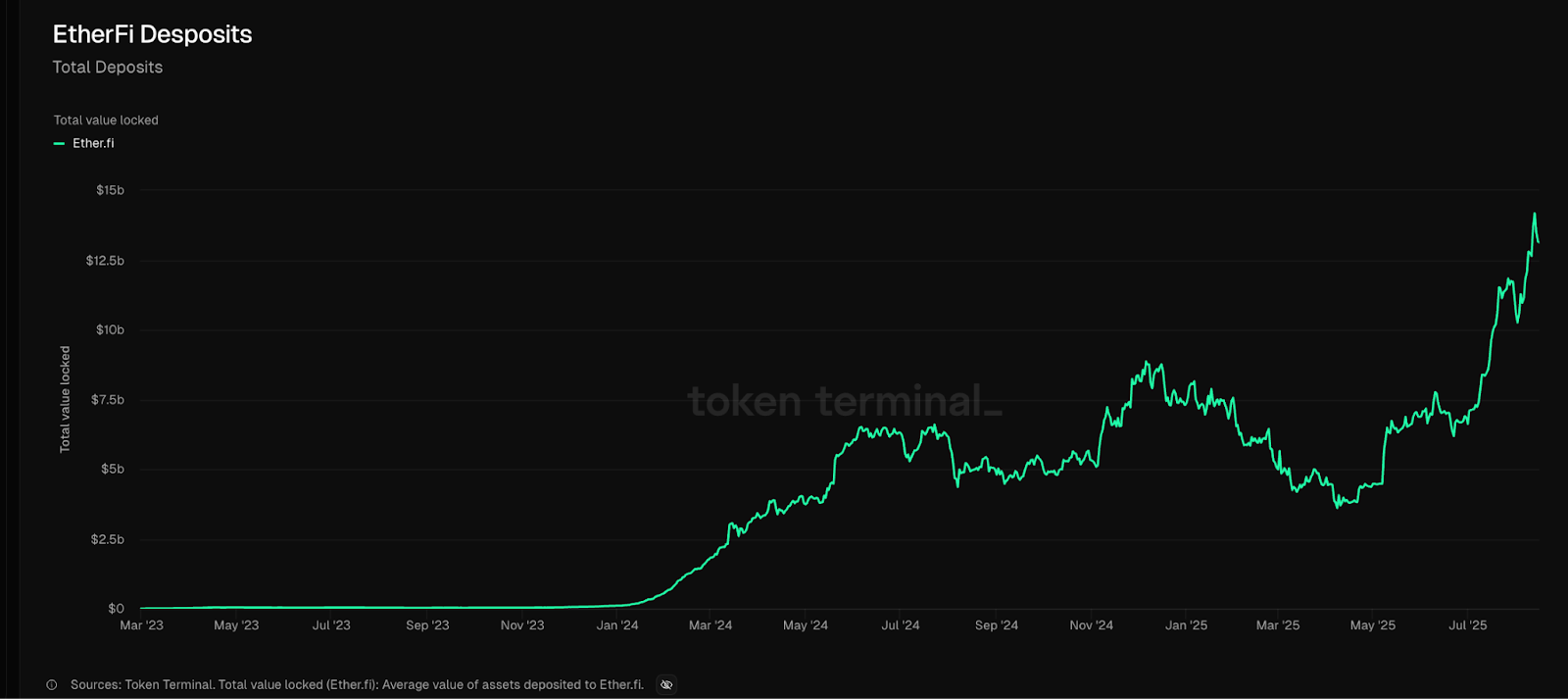

EtherFi was one of the first to build this pathway. What started as a simple liquid staking protocol for Ethereum quickly transformed into a trove of more than $12B worth of deposits. Rather than simply sit on these deposits and earn native yield from Ethereum staking services, EtherFi decided to productize their war chest. This meant everything from programmable portfolio management tools, like auto-rebalacing liquid vaults, to EtherFi Cash, a non-custodial Visa card that enabled users to spend their portfolio and earn cashback on purchases.

Other protocols are iterating on this approach and adding more crypto-native features. KAST, for instance, has developed a Visa-backed debit card that is tied directly to onchain activity. Users can seamlessly spend stablecoins like USDC, USDT, and USDe through Apple Pay and Google Pay integrations; however, spending rewards are converted into future tokens which are directly tied to a user’s Solana staking activity. So the more a user contributes to the Solana network, the higher their reward multiple potential is for spending.

This sets up a world in which users can stake Solana, deposit the liquid staking version into an onchain bank and not only spend it to make real world purchases, but increase their rewards with higher staking activity. Other parts of the stack, like Privy’s tap-to-pay functionality, are making in-person payments with crypto infrastructure even more web2 analogous.

Users now have the means to store their assets onchain, earn yield on idle capital, and utilize this capital to make real-world purchases with cards or their phone.

The next leg down is embedding this system directly into the user’s wallet, where the user maintains full control over the entire stack.

Onchain Sovereign Banks

Fully self-sovereign, onchain banking infrastructure is at the frontier of programmable finance. This gives users full autonomy over their assets, enables scalable and private payments, and perhaps most importantly, completely disintermediates from banks and legacy systems. It also enables users to establish and maintain digital identity.

In our view, a core issue with most of the current offerings is that they still rely on the very rails they were built to destroy. The end goal is to disintermediate banks and legacy systems, removing geographic boundaries to financial access while enabling freedom of capital movement and democratizing global investments.

Thus, while the emergence of DeFI primitives and the advent of stablecoins have created the foundations for self-custodial banking, the current interfaces for using these structures are broken. Complexity, privacy, and safety prevent real world adoption. Users still must go through many different steps to perform different actions and must have a nontrivial level of technical knowledge. Moreover, choosing a specific network or a token, finding an address, paying gas, bridging, swapping, and signing multiple transactions is still quite complex. All of this activity is also fully public for all to see, creating unnecessary attack vectors, both social and physical.

Users generally have two fundamental options: leave their balance on a centralized exchange (e.g. Coinbase) or use a wallet (e.g. MetaMask). Both have tradeoffs. CEXs are custodial solutions and as such carry all of the associated risk. They also take a substantial fee for performing basic functions like staking (e.g. 10% commission fees). Wallets, on the other hand, simply function as tools to view token balances and to sign transactions. They are not banks and do not have banking-like features.

Part of the end goal is to embed self-custodial, self-sovereign banking rails directly into the user experience. In many ways, this is the wallet level. Users can send stablecoin payments, earn yield simply by holding programmatic money, and use all of the different DeFi applications without the complexities of existing systems. Additionally, they must be able to do all of this, but while maintaining a threshold level of privacy.

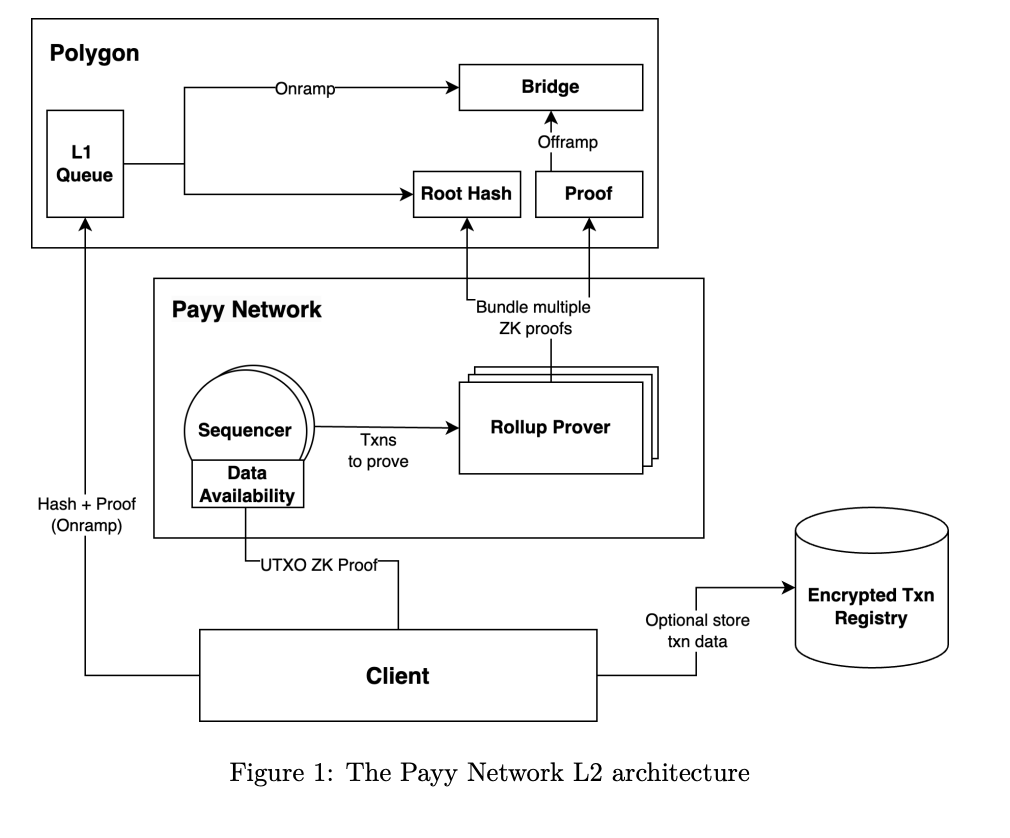

Much of this is starting to take form. Protocols like Payy, for instance, are building towards the edge of this through ZK primitives that embed privacy while maintaining performance and non-custodial proxies that allow users to seamlessly participate in any DeFi primitive, across chains with 1-click.

Other protocols like 3Jane are building real-time, uncollateralized stablecoin credit lines and are using primitives like zkTLS to connect onchain users with their off-chain credit data.

Ultimately, the goal is to allow users to bring fiat onchain, exchange it for digital assets, and begin to put these to work. No more idle capital, but instead easy-to-use frontends and user experiences that transform otherwise lazy assets into programmatic ones: assets that are constantly working for the end user, whether that’s earning T-bill yield, money market yield, LPing, looping, or countless other forms of capital coordination. All private, all censorship-resistant, all fully owned by the user. No intermediaries required.

Identity and Privacy

We believe another step forward is building an identity and compliance layer for smart wallets. All capital formation and coordination should begin at the wallet level. User savings accounts, tokenized money market funds, payment, and more start with the wallet.

As crypto payment rails integrate with and move beyond traditional infrastructure, they need to be both compliant and private, at the very bare minimum. This means that users can send basic payments and move between sophisticated assets in a fully compliant, and private, manner. Many payment providers are beginning to develop KYC/AML standards in a crypto-native, zero-knowledge way.

Part of the power here lies in the implications this has on retail adoption of self-custodial wallets. Users can operate on credibly neutral payment rails while maintaining their privacy and adhering to different compliance standards. This is a substantial improvement over legacy payments, which often involve high fees and slow settlement times.

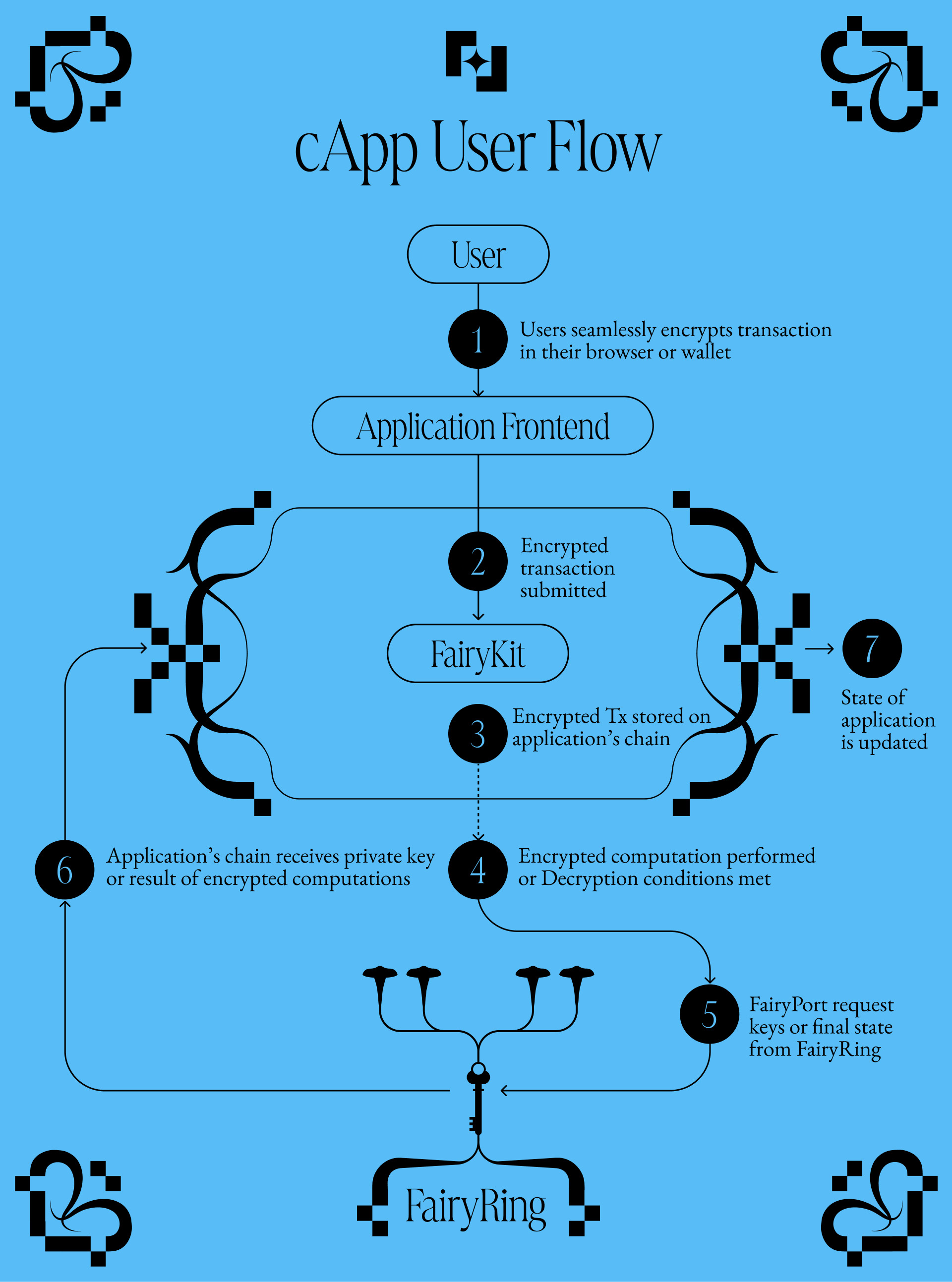

Many different privacy solutions are emerging to address these needs: from ZK and MPC to FHE and TEE. Yet, enterprise-grade consumer products need outcomes and execution, not narratives. Protocols like Fairblock are building policy-driven confidentiality that empowers a variety of different privacy primitives. For instance, Fairblock is FHE-friendly and treats TEEs as optional accelerators, not single anchors of trust. This seamless real world utility such as encrypting payment amounts while keeping addresses visible for composability or enabling disclosure via conditions (refunds, disputes, regulator review), all while being plug-and-play with existing chains so merchants do not need to migrate to a new “privacy chain.”

This next generation of tooling enables retail and institutions alike to simply onboard to any given network and begin sending digital dollars right away, from anywhere, and across the globe at ultra-competitive rates and faster finality. It also meets users precisely where they are by integrating with all systems, including credit cards, wire, ACH bank transfers, and stablecoin conversions. All with the same familiar tooling and experience that they are accustomed to.

DeFi 2.0: Programmable Finance

We believe that as we move towards this new frontier, the gap between the real world and the machine economy will narrow. Decentralized finance will fundamentally change from speculative yield to paradigm-shifting utility. Money will flow onchain more efficiently, capital will no longer sit idle, and the entire stack will be redefined.

Agentic highways will accelerate this. Coinbase’s x402 will create standards for agents to engage in commerce, and other primitives like crypto-native MCPs will emerge to bridge blockchain networks to external ones, creating open standards for agents to interact with any type of service, on- or off-chain. We believe this will enable all of the different human reasoning and decision-making skills that AI has in the web2 world to be possible on blockchains. The new world currently being shaped will come increasingly closer to the end user: an inner experience, feature-rich, and with ultra-accelerated utility.

Legal Disclaimer

[1] Certain information contained herein has been obtained from third parties. While such sources are believed to be reliable, Anagram Ltd. (“Anagram”) does not assume any responsibility for the accuracy or completeness of such information. No assurance is made by Anagram regarding the accuracy or completeness of the information or opinions set forth herein, whether or not obtained from third parties, and Anagram shall not be liable therefor. Certain statements herein are based on subjective beliefs, may differ from the views of other market participants and are subject to change. Please see the disclaimer below for more information.

[2] Anagram may have interest in companies or projects that are written about in this space. This content is for educational purposes only and does not constitute advice, marketing or solicitation for funding. Please see the disclaimer below for more information.

The information in this document has been prepared by Anagram Ltd. (“Anagram”) for informational purposes only. The contents herein, and content available on any associated distribution platforms, including Anagram online social media accounts, should not be construed as or relied upon as legal, investment, tax, or other advice.

Certain statements in this document constitute forward-looking statements, which may be identified by the use of forward-looking terminology such as “may,” “will,” “seek,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” “target, “plan” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially and adversely from those reflected or contemplated in the forward-looking statements. All forward-looking statements represent the views of Anagram at the time of writing and are subject to change without notice, and no representation or warranty is made as to the reasonableness of any such forward-looking statements.

Anagram and its affiliates may consult on, invest in, build or otherwise have interest in companies or projects that are written about in this space. This content is for educational purposes only and does not constitute advice, marketing or solicitation for funding.

Certain information contained herein has been obtained from third parties. While such sources are believed to be reliable, Anagram does not assume any responsibility for the accuracy or completeness of such information. No assurance is made by Anagram regarding the accuracy or completeness of the information or opinions set forth herein, whether or not obtained from third parties, and Anagram shall not be liable therefor. Certain statements herein are based on subjective beliefs, may differ from the views of other market participants and are subject to change.