The real estate market is broken. So we’re fixing it.

Real estate is the largest asset class in the world, yet it faces a fundamental access problem.

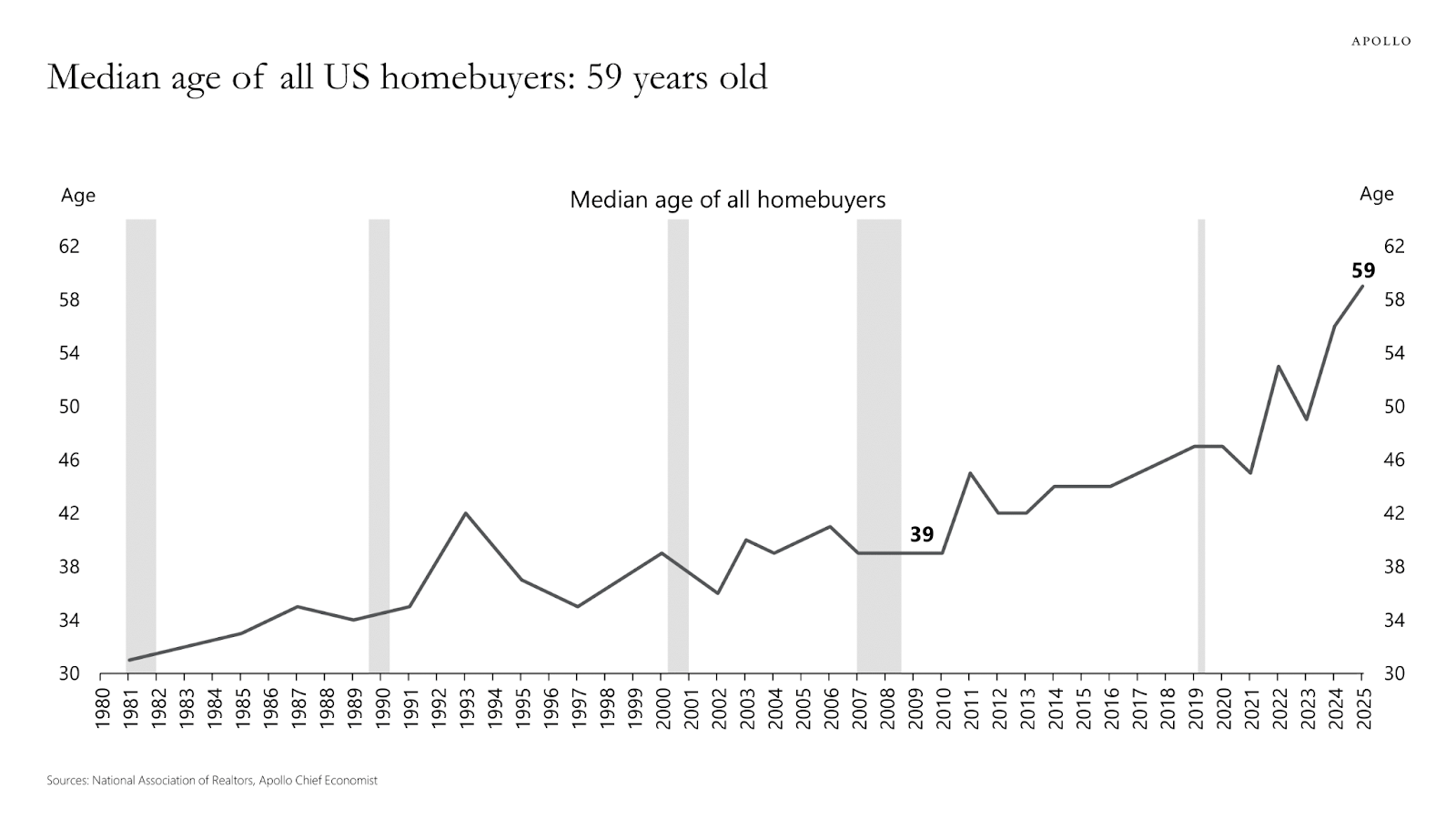

The median age of U.S. homebuyers recently hit a record high of 59 years old, and homebuyers over the age of 70 now outnumber buyers under the age of 35. A long list of economic factors contribute to the average consumer being squeezed at both ends. Persistent inflation and currency devaluation have made saving harder; the cost of everyday economic participation now absorbs the majority of a typical family’s income; and home prices in aggregate have risen far faster than wages. The reality is that the average consumer in today’s economy is simply priced out of participating in the world’s most important asset class.

The lack of access to these markets doesn’t imply a lack of interest. In fact, quite the contrary. The truth is that nearly everyone has an opinion on real estate. People follow celebrity homes religiously, scroll Zillow endlessly, and always manage to bring up how hot Silicon Valley’s housing market is in social settings. Many people even feel they have an information edge in the market. Some live in an up-and-coming neighborhood, work in an underrated zip code, sense an influx of industry or talent entering their city, or can feel housing demand shifting block by block. Despite this, expressing a clear view on the market has been a virtual dead-end. REITs, ETFs, and indices represent broad macro exposure across a curated selection of these markets, and “just buy a house” is clearly not a consumer financial product.

Moreover, price discovery in real estate has historically been a challenge. Today’s markets represent a patchwork of proxies, including listing prices, comps, and automated valuation models (AVMs) like Zillow’s Zestimates. These accepted sources of truth are inherently lagging, sometimes inaccurate, and never tradeable in a way that reflects real-time market consensus. Closing home prices function as the ground truth, but they arrive after the fact. Traditional financial products give you index-shaped exposure. No technology currently gives you a micro-level, always-on market that compresses information into a live price.

This is our core ambition in building PricedOut. Last October, we set out to create a platform where everyday users can gain exposure to the most important asset class in the world. Built from the ground up, it will represent the product we wished existed today. At its core, PricedOut will be a consumer-facing application, sitting atop a price-discovery layer hosting the industry’s most real-time pricing information. The feature set is ever-growing, but some of the key offerings will include:

- The ability to make financial predictions on the closing price of individual homes.

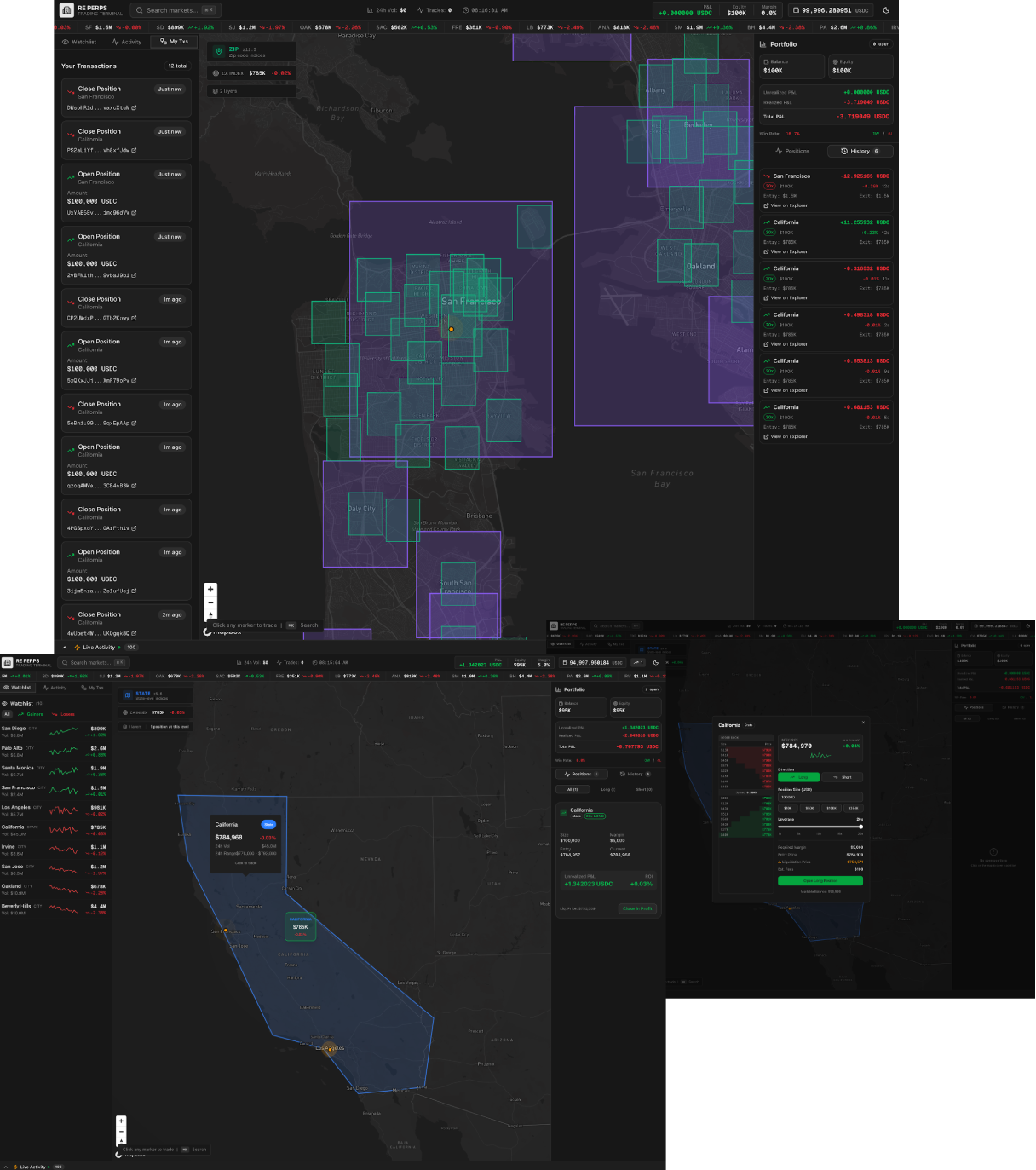

- Access to leveraged trading on prices across a broad range of markets.

- Financial exposure to real estate at both a micro and macro level (think houses, neighborhoods, zip codes, cities, and even states).

- A holistic platform where anyone can access the most real-time pricing data in the history of the asset class and hedge their portfolio exposure.

Most approaches to merging crypto and real estate have started by tokenizing the underlying asset; this involves wrapping SPVs, fractionating ownership, and navigating regulation. We’re taking the opposite approach. We’re starting with what crypto does exceptionally well: price discovery and true financial product innovation (e.g., prediction markets and perps). By starting with price, we can onboard users immediately without the friction of asset custody, while simultaneously building the infrastructure that makes the underlying markets more efficient.

Product Overview

PricedOut represents the killer consumer app built on top of the first real-time price discovery layer for real estate. The goal is to create a platform where anyone can trade their views on real estate, while the system simultaneously compresses scattered signals into live, consensus prices. Under the hood, we’re building two tightly coupled components:

- A prediction market layer (more technically a distribution market) that creates reliable price discovery on home sale prices.

- A perpetuals layer that turns this price discovery into an always-on, tradeable instrument with leverage.

With these mechanisms, our goal is to create two powerful products coupled into one platform:

- A prediction market and trading platform accessible to the average consumer.

- A real-time, price discovery infrastructure layer where sophisticated entities can both derive pricing data and hedge the price or interest rate risk of their existing exposure.

On the consumer side, PricedOut will feel like a modern trading app purpose-built for real estate. Users will be able to pull up markets the same way they pull up listings today—by home, neighborhood, zip code, city, or state—and instantly see a live price with an implied range that reflects real-time market consensus. From there, participating is simple: they can place a prediction on where a home clears, trade a broader regional market, or use leverage through perps to increase directional exposure.

The intent is for this to be intuitive even for users who have never touched crypto or derivatives. They’ll find a streamlined interface, easy navigation, transparent settlement, and a mobile experience that makes trading these markets feel as normal as checking prices on Zillow.

In parallel to this, we’re building both the pricing and hedging layer for institutions that have current exposure in their portfolios. For allocators, real estate funds, builders, lenders, operators, and other sophisticated entities, the core value is twofold: (1) access a real-time data layer that surfaces market-implied valuations at multiple resolutions, and (2) gain a set of hedging primitives that lets them offset risk dynamically without waiting for periodic appraisals or relying on rigid indices as proxies. Over time, this institutional platform becomes a new data and risk-management tool for those with significant interest in the asset class.

With this platform, our long-term ambition is straightforward: make real estate tradeable at every resolution, from single homes to regional indices, while simultaneously producing the most real-time pricing data layer the asset class has ever had. For PricedOut users, that means access, speculation, and hedging. For institutions (funds, builders, lenders, operators) it becomes a new data and risk management stack that moves far beyond rigid indices and periodic appraisals.

We’re excited to bring this platform to life, and we’ll have more to announce over the coming weeks. As always, we’ll welcome any feedback from early users as we build in public.

We're also hiring specifically for the new company that will launch this product. If you’re excited about building at the intersection of real estate, prediction markets, and leveraged trading and want to spearhead this initiative from the ground up, please reach out at info@anagram.xyz.

LEGAL DISCLAIMER

The information in this article has been prepared by Anagram Ltd. (“Anagram”) for educational and informational purposes only. PricedOut will be offered by a separate legal entity distinct from Anagram. Under no circumstances should this, or any post on this website, be construed as solicitation for investment in Anagram, its affiliates, or any projects named herein or otherwise. The contents herein, and content available on any associated distribution platforms, including Anagram online social media accounts, should not be construed as or relied upon as investment, legal, tax, or other advice.

Certain information contained herein, including in charts and graphics, may have been obtained from third parties. While such sources are believed to be reliable, Anagram does not assume any responsibility for the accuracy or completeness of such information. No assurance is made by Anagram regarding the accuracy or completeness of the information or opinions set forth herein, whether or not obtained from third parties, and Anagram shall not be liable therefor. Certain statements herein are based on subjective beliefs, may differ from the views of other market participants, and are subject to change.

This presentation contains “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially and adversely from those reflected or contemplated in the forward-looking statements.

Anagram and its affiliates may consult, invest, build, or otherwise have interest in companies or projects that are written about in this space. This content is for educational purposes only and does not constitute advice, marketing or solicitation for funding.