Introduction

The validator landscape is quickly evolving from generic Proof-of-Stake (PoS) network security and passive yield into a hyper competitive race to become the fastest operator, building the densest blocks, and servicing the most network traffic. This is transforming validators into highly optimized and sophisticated financial engines, positioning them as a foundational layer for products and applications. Simple staking is no longer sufficient. Only the strongest will survive.

Enter: the Ultra Validator.

When Anagram spun out its validator, Anagram Staking Services*, it began as a way to both secure our own stake and test Solana’s limits. What started as a passive yield engine has evolved into an enterprise-grade validator that is consistently delivering best-in-class performance while pushing the boundaries of block optimization, network throughput, and value creation.#

We view our validator not just as infrastructure, but as a positive-sum engine for Solana: profitable for delegators, performance-enhancing for the network, and a foundation for ongoing innovation.

Over time, we plan to expand it into a suite of products that sharpen validator performance and unlock differentiated value for delegators. This includes performance-driven enhancements such as MEV-aware block packing, low latency execution, and confidential order routing, as well as enterprise services such as custom reporting, treasury management integrations, and delegated yield strategies. Our goal is to transform validation from a commodity service into a platform that delivers unique experiences and compounding advantages. We believe this is the frontier of Ultra Validators.

By staking with Anagram Staking, enterprises can align with a validator that is purpose-built to turn validation into value creation, driving superior returns# while directly strengthening the growth and resilience of the entire Solana network.

From Passive Yield to Performance Engines

In the early days of Proof-of-Stake, validators served a straightforward purpose: sign blocks, maintain consensus, and collect rewards. This model is becoming increasingly obsolete. The next generation of validators is engineered for speed, reliability, and capital efficiency. Simple staking has given way to carefully tuned block-production strategies and complex yield optimization. Validators are no longer content with baseline returns; they are being reengineered to capture more value per slot and to reinvest that yield in products that compound their advantage.

The shift is structural and the economics are powerful. High-performance validators enhance network security, support higher throughput, and settle more value – all of which attract additional stake in a self-reinforcing cycle. As institutional inflows accelerate, competition for stake weight continues to intensify. Pure financial engineering is no longer enough. Operators must now innovate simultaneously at the software, hardware, and network layers to stay ahead.

The Ultra Validator

At the forefront of this transformation is the Ultra Validator, a new class of infrastructure built to outperform traditional nodes across every metric. Ultra Validators operate as both financial engines and innovation platforms. Their surplus yield does not sit as idle capital but instead becomes programmable fuel for automated vault strategies, new forms of consumer credit, and even new venture structures where staking rewards fund investments without ever touching principal.

Institutional capital is already amplifying these dynamics. Digital Asset Treasuries (DATs) are fast-growing sources of deposits, while the first-ever staking ETFs are now emerging. With regulatory clarity increasing, asset management giants from BlackRock to Fidelity are preparing products that will channel even more institutional stake into PoS networks. These inflows ultimately demand best-in-class validator infrastructure. At a minimum, we believe that ETFs and DATs need to secure the most competitive native yield, but to differentiate themselves they also require deeper integrations into decentralized finance and the ability to route rewards dynamically to higher-performing opportunities in real time.

The economics of the validator layer are already showing signs of a race to zero on commissions. Many validators are cutting fees as a blunt instrument to attract stake, sacrificing greater portions of block rewards in the process. But fee compression is not a sustainable advantage – it’s a temporary lever in a market that is quickly evolving past simple incentives.

The next frontier is dynamic yield routing, where validators autonomously direct rewards into vaults, lending pools, and active capital strategies, enabling delegators to earn continuously optimized returns without surrendering liquidity. Staking will continue to provide the baseline for network security, but it is performance that will increasingly drive superior returns. As more capital flows in through DATs, ETFs, and other vehicles, we expect the value of both networks and their native assets to grow in tandem.

Anagram Staking Services: Anagram’s Ultra Validator^

Anagram Staking was built for this new paradigm. As a purpose-built Ultra Validator designed to push the limits of Solana’s transaction scheduling and staking economics, the system integrates two breakthroughs.

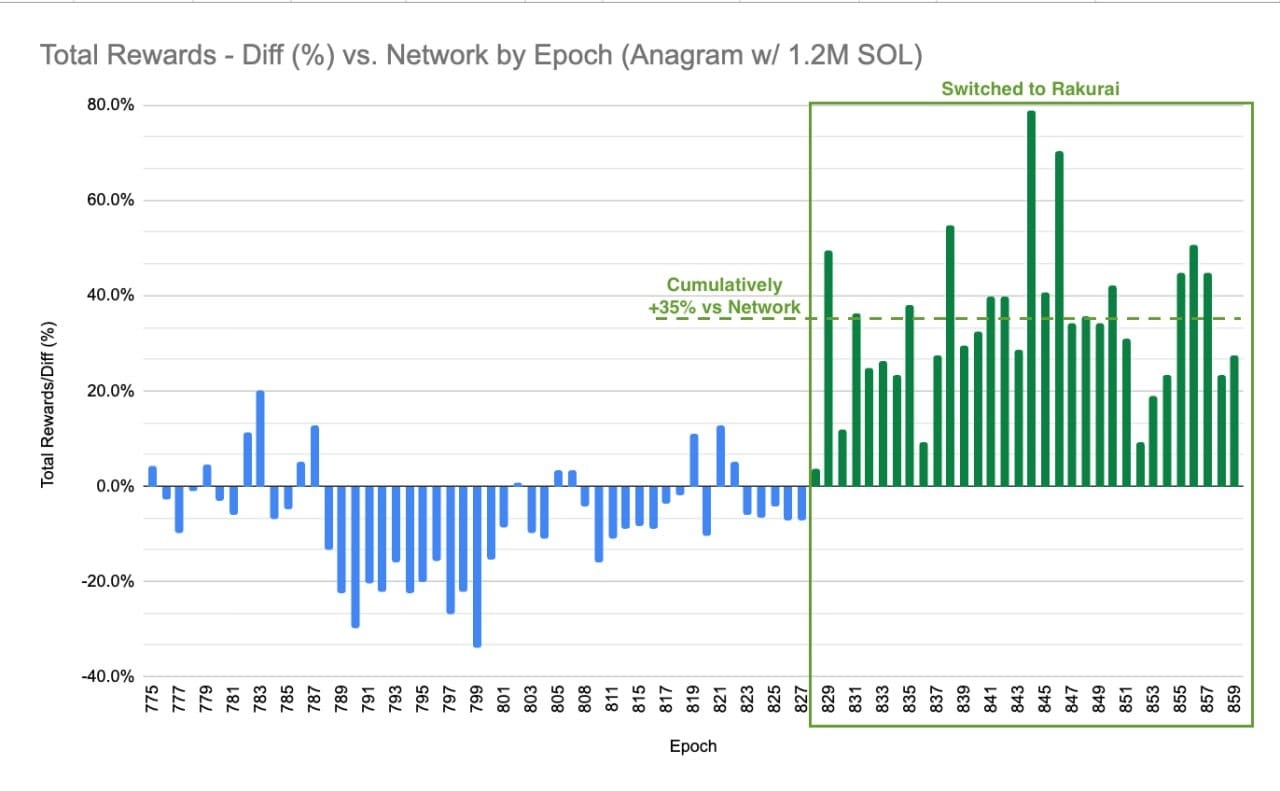

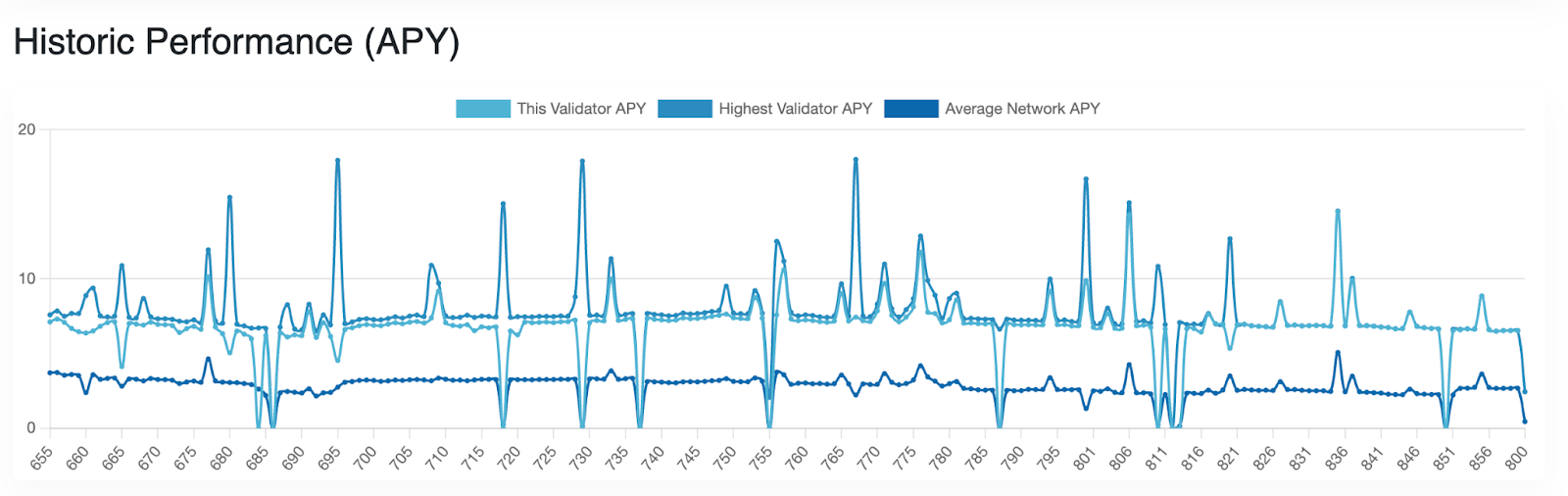

The first is Rakurai*, an advanced scheduler and block-packing framework that reorganizes how Solana transactions are sorted, prioritized, and executed. Rakurai’s proprietary transaction pipeline and optimized network processing eliminate the bottlenecks that have long constrained Solana DeFi. This maximizes throughput, and enables clients to pack bigger and denser blocks. The results are measurable. Rakurai has consistently generated upwards of 8% staking rewards compared with the network average of ~6.5%, along with recent per-block rewards reaching as high as 0.166 SOL on average.

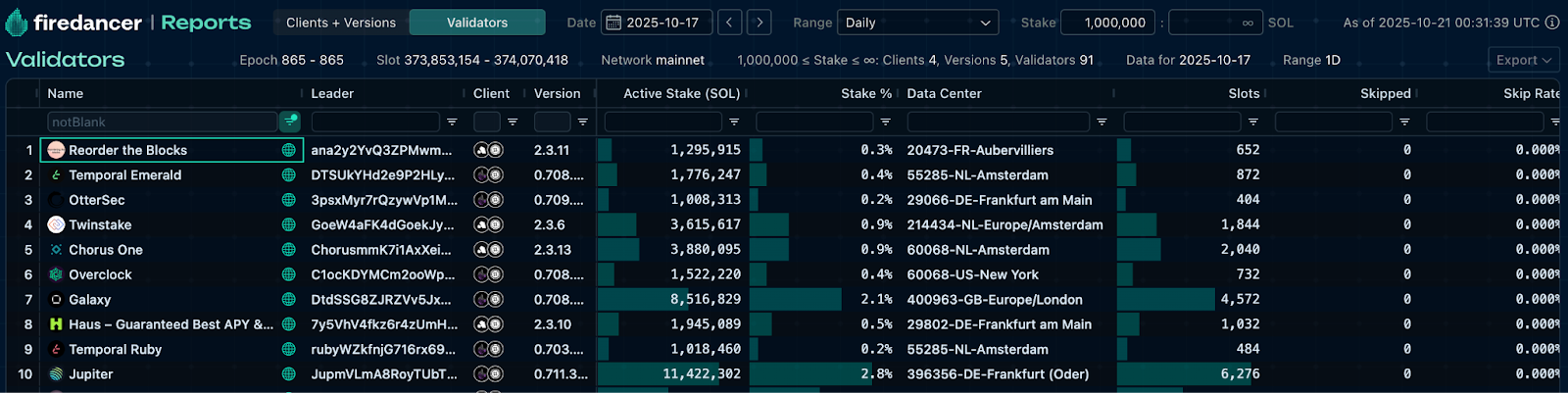

Since activating Rakurai at Epoch 827/828, Anagram Staking has consistently packed around 1,431 transactions per slot, outperforming the cluster average of roughly 1,370 (a 5% improvement). Compute units per block, the leading indicator of aggressive block optimization, are now well above the cluster median. As a result, staking rewards have outpaced the Solana mainnet-beta average by roughly 35%, with periods of performance more than doubling baseline yields.

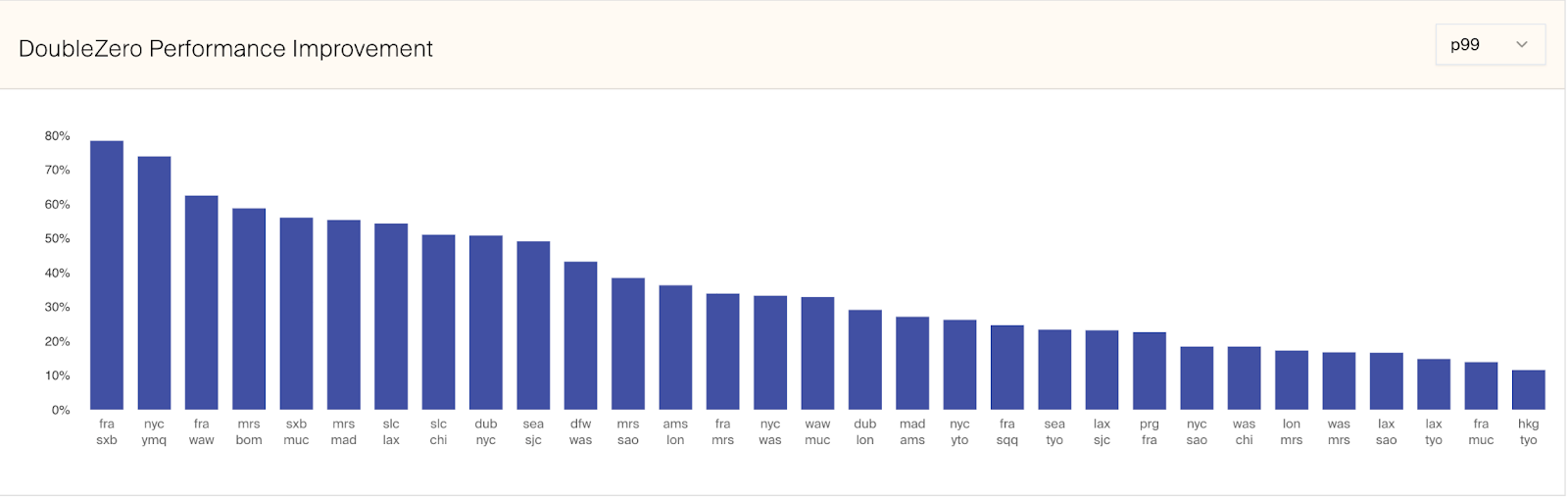

The second innovation is DoubleZero*, a fastlane Internet layer engineered to bypass the bandwidth limits and routing inefficiencies of the public internet. Blockchain performance ultimately depends on how quickly validators can communicate, and traditional Internet infrastructure imposes hard latency ceilings. DoubleZero uses a dedicated global fiber network that spans land and sea to cut inter-validator latency by several milliseconds. This faster propagation translates directly into more reliable transaction landing, higher block inclusion rates, greater block-reward capture, and ultimately higher capital velocity.

Together, both Rakurai and DoubleZero allow Anagram Staking to handle more network traffic, land transactions with higher reliability, and deliver Web2-grade user experiences for applications built on Solana.# Applications can execute faster, land transactions more predictably, and offer interfaces that rival—or even surpass—those of enterprise-grade financial software. As programmable finance expands into mainstream payments, credit, and capital markets, this level of performance is not just desirable but essential.

The impact of these design choices is measurable. Since March, Anagram Staking Services has grown from roughly 200,000 SOL in delegated stake to over 1.6 million SOL, reflecting growing confidence from both retail and institutional stakers alike.# Additional proportional rewards are being distributed to select delegators, pushing their annualized returns above what can be achieved through liquid staking tokens or even most high-performance validators. Performance data from Solana Compass and Anagram’s internal Sauron dashboards confirm sustained improvements across compute utilization, block size, and vote latency since Rakurai activation. More efficient block packing has directly increased block capacity and, in turn, yield capture. On average, our validator outperforms the median staking rewards from traditional staking infrastructure on Solana mainnet-beta cluster by approximately 28%, and in some epochs has doubled the baseline yield.

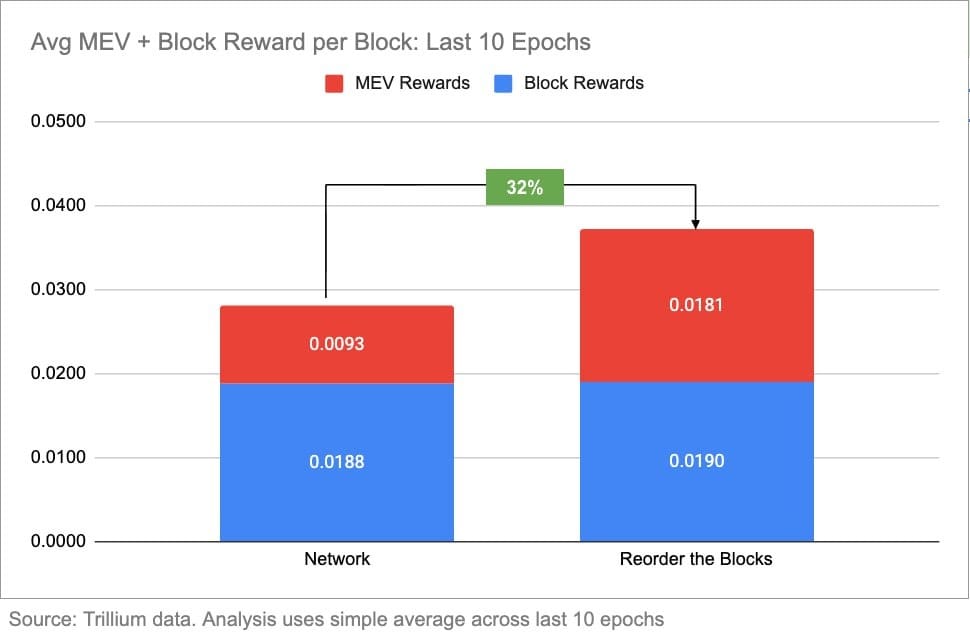

Smarter transaction packing prioritizes the highest-value transactions and maximizes reward extraction. Moreover, our Jito integration compounds these advantages by enabling more MEV capture, which further enhances block rewards. Collectively, this has increased overall block rewards on our validator by 42%.#

Anagram Staking Services consistently outperforms the rest of the network in terms of both pure Block Rewards and MEV Rewards.

Beyond Staking: Programmable Capital

But higher rewards are only the beginning. Anagram Staking is built for productization, turning surplus block rewards into programmable capital that can support entirely new financial primitives. Excess yield can be deployed into liquidity provision, lending markets, or vault strategies that dynamically shift capital across Solana DeFi to maximize returns while preserving liquidity.

The validator also integrates seamlessly with another product built and spun out by Anagram, the non-custodial yield platform Breeze, which automatically directs additional block rewards into optimized yield strategies.

More experimental and speculative ideas are also on the table. One example is Buy Now, Pay Never, in which stakers lock future rewards for a predefined period and spend against them immediately, effectively transforming staking into a form of yield-backed credit. In another model, validator-powered venture finance, investors place capital into the validator and use its proceeds to fund early-stage investments while leaving the principal untouched. Moreover, validators could even power targeted ecosystem growth, potentially enabling projects to airdrop tokens directly to long-term participants based on staking contributions.

This is more than a technological upgrade. We believe it is the outline of a new capital stack for programmable finance. Validators are evolving into increasingly active market participants—securing networks, generating differentiated yield, and fueling new innovation. They cease to be passive infrastructure and become a foundation for new businesses and financial products. The validator layer is no longer just the backbone of blockchain security, but rather a launchpad for the next generation of onchain applications.

These implications are likely to ripple outward. DeFi protocols can count on higher and more predictable yields. Digital Asset Treasuries and staking ETFs gain a native partner for their onchain asset management strategies. And developers can design consumer applications that rest on the validator’s programmable yield, unlocking capabilities that did not exist when staking was a static, low-touch activity. The cumulative effect is a self-reinforcing performance loop: better validators drive higher network throughput and value settlement, which attracts more stake and capital, which in turn funds further innovation.

The New Standard

The era of passive staking is over. Yield-maximizing Ultra Validators are setting the new standard and redefining what it means to participate in network security. Anagram Staking demonstrates what this new standard looks like in practice: consistently packing more transactions per slot, sustaining a yield premium of nearly 30%, and scaling delegated stake from hundreds of thousands to well over a million SOL in a matter of months. With Rakurai’s advanced scheduler and DoubleZero’s dedicated fiber network, Anagram Staking demonstrates how next-generation validator design can unlock Web2-grade performance and entirely new financial primitives.

And this momentum is only accelerating. Lower latency, faster transaction inclusion, and permissionless auto-compounding of block rewards will drive even greater returns for delegators. The validator will seamlessly scale with upcoming Solana network upgrades, including 100M block compute units, positioning it to capture a share of future network growth.

Ultra Validators will also expand the design space of onchain capital coordination and experimentation. We expect staking rewards will continue to evolve from static emissions into dynamic flows, dynamically routed across vaults, lending pools, and active capital managers in real time as conditions change.

Staking once meant signing blocks and collecting rewards. Tomorrow it will mean running a programmable financial engine at the heart of a global network. Ultra Validators are the beginning of this future.

STAKE HERE: https://stake.anagram.xyz/

[*] Anagram Ltd. and its affiliates may have interest in companies or projects that are written about in this space. This content is for educational purposes only and does not constitute advice, marketing or solicitation for funding. Please see the disclaimer below for more information.

[#] Certain statements in this document constitute forward-looking statements. No representation or warranty is made as to the reasonableness of any such forward-looking statements. Past results reflected herein do not guarantee future performance. Please see the disclaimer below for more information.

[^] Staking rewards may be considered securities under federal and state securities laws. Staking involves significant risks and may not be available to residents of certain jurisdictions. Please see the disclaimer below for more information.

LEGAL DISCLAIMER

The information in this document has been prepared by Anagram Ltd. (“Anagram”) for informational purposes only. The contents herein, and content available on any associated distribution platforms, including Anagram online social media accounts, should not be construed as or relied upon as legal, investment, tax, or other advice.

Certain statements in this document constitute forward-looking statements, which may be identified by the use of forward-looking terminology such as “may,” “will,” “seek,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” “target, “plan” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially and adversely from those reflected or contemplated in the forward-looking statements. All forward-looking statements represent the views of Anagram at the time of writing and are subject to change without notice, and no representation or warranty is made as to the reasonableness of any such forward-looking statements.

Anagram and its affiliates may consult on, invest in, build or otherwise have interest in companies or projects that are written about in this space. This content is for educational purposes only and does not constitute advice, marketing or solicitation for funding.

Certain information contained herein has been obtained from third parties. While such sources are believed to be reliable, Anagram does not assume any responsibility for the accuracy or completeness of such information. No assurance is made by Anagram regarding the accuracy or completeness of the information or opinions set forth herein, whether or not obtained from third parties, and Anagram shall not be liable therefor. Certain statements herein are based on subjective beliefs, may differ from the views of other market participants and are subject to change.

Staking rewards may be considered securities under federal and state securities laws. No securities or other regulatory authority has reviewed or approved this information. Any decision to stake should be made only after consulting with qualified legal and tax advisors.

Staking involves significant risks including, but not limited to: slashing, regulatory changes, software bugs, network or infrastructure failures, unbonding periods, and other technical and liquidity risks. Past results reflected herein do not guarantee future performance. Token values may fluctuate significantly, and you may lose some or all of your staked tokens. Staking rewards are not guaranteed and may vary based on network conditions. Only stake what you can afford to lose entirely.

The regulatory landscape for digital assets and staking is rapidly evolving and uncertain. Future regulatory developments may materially affect staking activities, validator operations, or token values. Users should monitor regulatory developments and may need to cease staking activities if required by applicable law.

Staking services may not be available to residents of certain jurisdictions. This communication is not directed to any person in any jurisdiction where such distribution would be contrary to local law or regulation. By participating in staking with Reorder the Blocks, you represent that your participation is lawful in your jurisdiction and that you meet all applicable eligibility requirements. Reorder the Blocks reserves the right to restrict access based on geographic or regulatory considerations.